The Close Brothers Asset Finance Business Sentiment Index (BSI) has continued to rebound, rising to record levels as confidence returns to key sectors, most notably in Manufacturing, which broke through the 40-point mark for the first time, in spite of the well-publicised supply chain delays, slower new order growth and rising material and labour shortages.

According to the monthly purchasing managers’ index, manufacturing production increased for the sixteenth consecutive month and jobs growth was registered for the ninth month running.

Manufacturers remained positive for the year ahead with nearly two thirds of firms predicting their output would increase during the coming 12 months, compared to 6% expecting a contraction. The confident outlook was attributed to recoveries in both domestic and global markets, reduced difficulties from supply chains, COVID-19 and Brexit and planned new product launches.

Challenges facing manufacturers include production schedules being disrupted by a combination of input shortages, longer supplier lead times and capacity constraints, including difficulties with staff shortages and hiring staff with the required skills. Average vendor lead times also increased significantly because of delays to air, land and sea freight, staff shortages, COVID-19 and Brexit disruptions, a lack of delivery drivers, and port delays.

About the BSI

The BSI is calculated and based on business owners’:

- Appetite for investment in their business in the coming 12 months

- Access to finance and whether they’ve missed a business opportunity through lack of available finance

- Views about the UK’s economic outlook

- Thoughts on their likely performance in the coming 12 months

Appetite for investment

Firms’ appetite to invest increased strongly, returning the sector’s strongest figures ever recorded for this measure with more than three quarters of respondents indicating they plan to seek funding for business investment in the coming 12 months.

Looking ahead at potential headwinds, 65.3% of manufacturers have pinpointed Brexit as a cause of concern, saying it has made it both more difficult to buy from – and sell to – the EU.

Is your business concerned about the impact Brexit is having on your business’ usual trading?

Missed opportunities

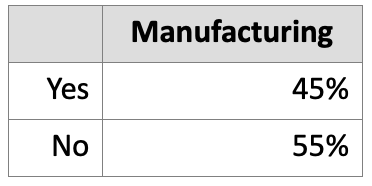

Nearly half of manufacturing firms have missed a business opportunity because of a lack of available finance despite the availability of government-backed loans. Many businesses now require additional finance to enable them to invest in growth and continue their recovery.

Q: Have you missed a business opportunity in the last 12 months, due to lack of available finance?

Cashflow is, by some distance, the biggest concern Manufacturers currently have, with 34% selecting the option. This is followed by competitive pressure, late payments (both 14%) and the lack of skills staff (10%).

Economic outlook

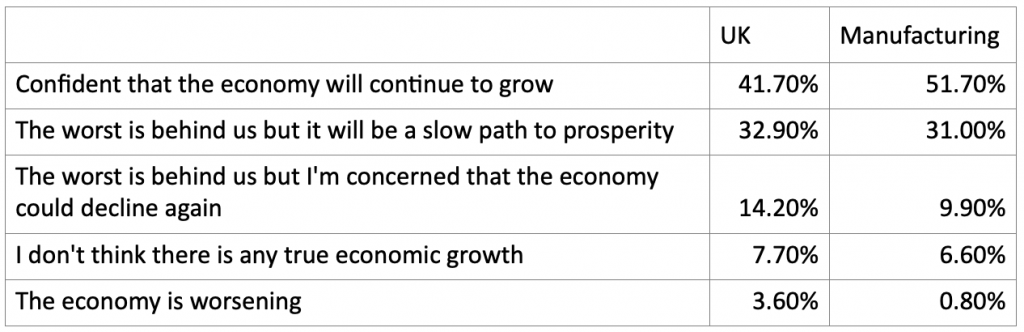

Positivity about the economic outlook continued to rebound after a strong increase earlier in the year.

Over half of Manufacturers (52%) expect the economy will continue to grow while a further third anticipate a ‘slow path to prosperity’. Only 7% feel there hasn’t been any real economic growth.

How would you best describe your business’s current economic outlook?

Predicted business performance

After a surge in business growth confidence in April, 44% of Manufacturers predict their operations will expand, up from 39%. Nearly half (46%) think they will ‘stay the same’ into 2022; only 9% foresee a contraction.

Leave A Comment

You must be logged in to post a comment.